Consumer Rights

What is the Fair Debt Collection Practices Act?

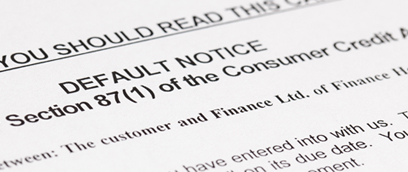

Congress enacted the Fair Debt Collection Practices Act (“FDCPA”) in 1977 to prohibit abusive, deceptive and unfair debt collection practices by third-party debt collectors. The FDCPA also seeks to promote consistent state action to protect consumers against debt collection abuses.

Under the FDCPA, consumers are protected from certain debt collection practices including false or misleading representations, unfair practices, harassment or abuse and furnishing deceptive forms. Statutory damages for FDCPA violations are set at $1,000 per case. In addition to statutory damages, the claimant can recover actual damages and attorneys’ fees/costs. The FDCPA has a 1-year statute of limitations that runs from the date of the occurrence.

What is the Telephone Consumer Protection Act?

The Telephone Consumer Protection Act (“TCPA”) prohibits the use of any auto-dialers and predictive dialers or an artificial or prerecorded voice to place calls to any wireless number except for emergency purposes or with the party’s express consent. The TCPA applies to any party engaged in prohibited use of auto-dialers and predictive dialers/prerecorded voices to place calls including debt collectors and telemarketers.

The victim of unauthorized calls may seek an action for injunction, recover actual monetary losses, or receive up to $500 in damages for each violation (whichever is greater). In addition, if the court finds that the defendant willfully or knowingly violated the TCPA, the court may, in its discretion, increase the amount of the award to an amount equal to not more than $1,500 per violation.

What is the Fair Credit Reporting Act?

The Fair Credit Reporting Act (“FCRA”) regulates the collection, dissemination, and use of consumer information, including consumer credit reports. Among other things, the FCRA protects consumers from unauthorized access to their credit information, requires creditors and employers to disclose if they have rejected the consumer or taken an adverse action against the consumer (such as a higher interest rate), and creates a procedure for correcting erroneous and/or incorrect information present in a consumer’s credit history.

For negligent violations of the FCRA, the claimant may be able to recover actual damages and attorneys’ fees and costs. For willful noncompliance, a claimant may recover the greater of either actual damages or a statutory minimum of $100 to a maximum of $1,000, plus punitive damages, and attorneys’ fees and costs.

Black & LoBello’s Consumer Protection Services

Black & LoBello’s attorneys protect consumers’ rights by bringing legal claims against abusive debt collectors and companies that make false or misleading representations in consumer reports. Claims under the FDCPA, TCPA and FCRA can be brought at little cost to the consumer. If you have been the victim of abusive or unfair debt collection practices, or improper credit reporting, contact the consumer protection attorneys at Black & LoBello at (702) 869-8801.